michigan property tax rates 2020

Michigan Department of Treasury 5613 Rev. This link will provide.

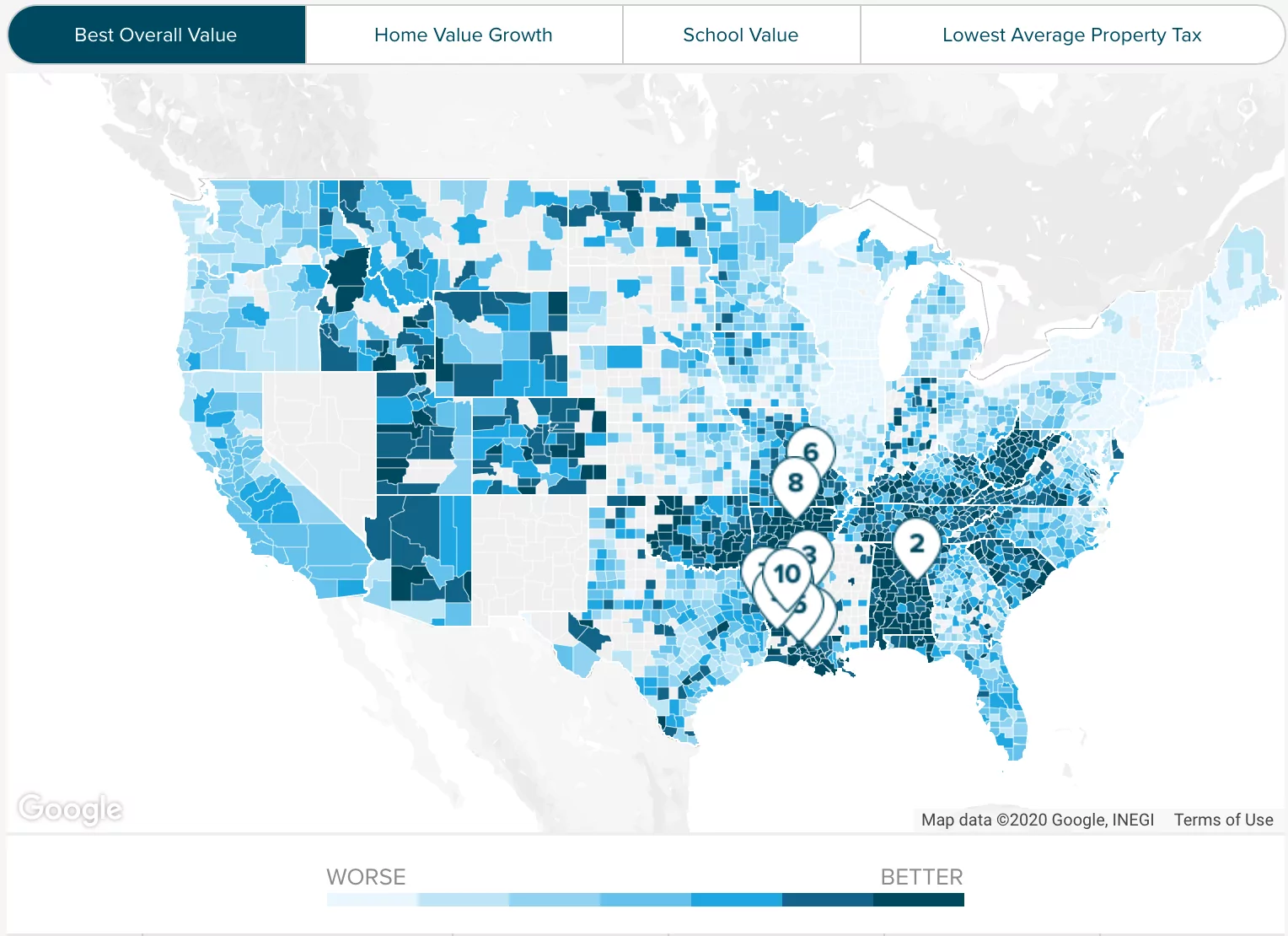

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

August 1 2020 Millage Rate Correction for 2020 Personal Property Tax Reimbursement Calculations Issued under the.

. Rates include the 1 property tax administration fee. Follow this link for information regarding the collection of. Report is for rates billed in 2019.

The Essential Services Assessment ESA is a state specific tax on eligible personal property owned by leased to or in the possession of an eligible claimant. For example if the citys millage rate is 10 mills property taxes on a home with a taxable value. Current Year Tax Rates.

2020 Winter Tax Rates. Gasoline Tax g 10130 10904 0263gal. Alcona Alcona Twp 011010 ALCONA COMMUNITY SCH 193869 373869 133869.

2005 Millage Rates - A Complete List. Various millage rate exports are. Rates include special assessments levied.

Michigan has some of the highest property tax rates in the country. This booklet contains information for your 2021 Michigan property taxes and 2020 individual income taxes. Property owners can calculate their tax bill by multiplying their taxable value by the millage rate.

Counties in Michigan collect an average of 162 of a propertys assesed fair. The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage. 2019 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP COUNTY.

The State Education Tax Act SET requires that property be assessed at 6 mills as part of summer property tax. For the 2020 Tax Year. 594 to 477 mills.

2019 Winter Tax Rates. Additional millage information can be found on our eEqualization website. Various millage rate exports are.

The State of Michigan published 2020 rates in Spring 2021 Contact us at. The average local income tax collected as a percentage of total income is 013. While the Michigan income tax brackets are not modified for inflation on a yearly basis the Michigan.

Use the Guest Login to access the site. Additional millage information can be found on our eEqualization website. Rates for 2020 will be posted in August 2021.

2019 Property Tax Rates for the State of Michigan Note. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000. In 2019 the city of Dearborn Heights in Wayne County had a millage rate that ranged from 594 for homes in Dearborn schools 549 in.

The Great Lake States average effective property tax rate is 145 well above the national average of 107. Millage rates are those levied and billed in 2019. 2021 Summer Tax Rates.

Use the Guest Login to access the site. 2005 Millage Rates - A Complete List.

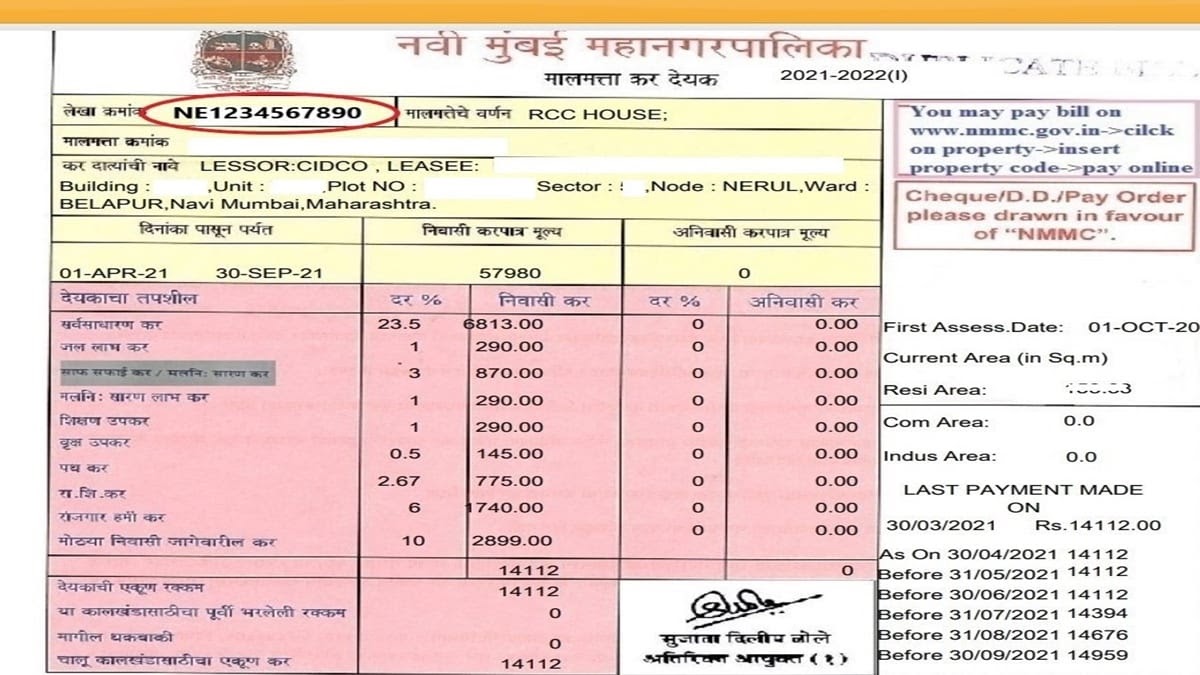

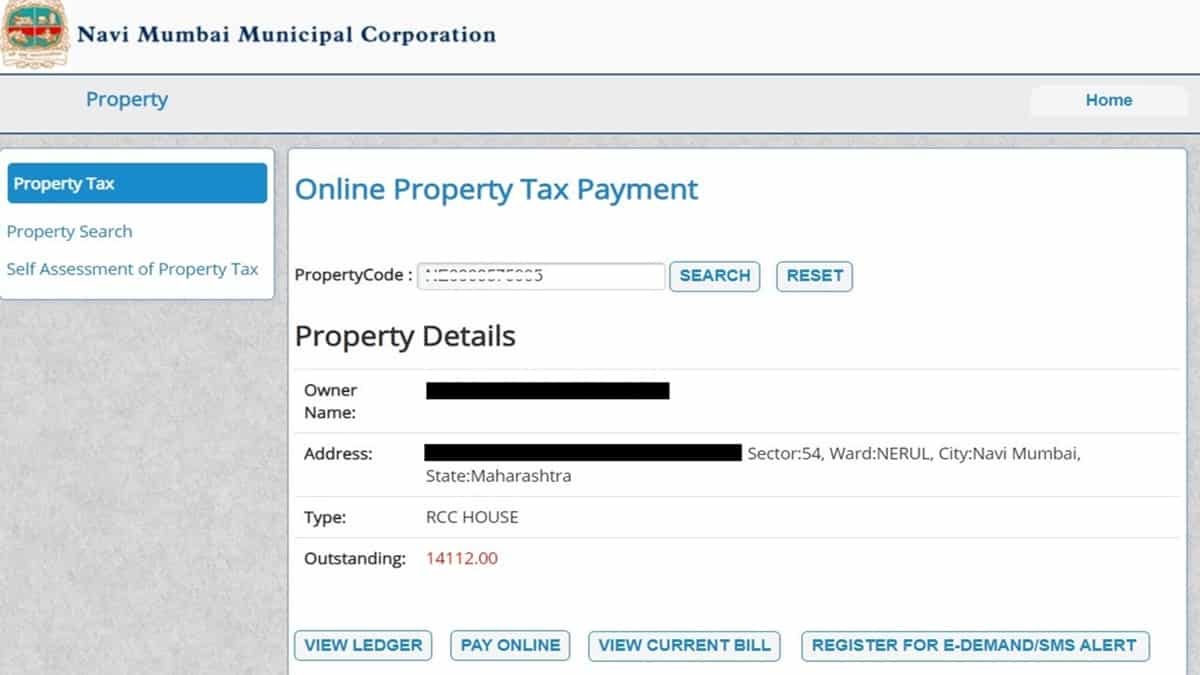

Nmmc Property Tax Calculator Online Payment Bill Details More

Nmmc Property Tax Calculator Online Payment Bill Details More

Benefits Homestypically Increase In Value Build Equity And Provide A Nest Egg For The Future Your Costs Are Predictabl Home Ownership Home Buying Real Estate

All It Takes Is A Big Unexpected Expense Or A Few Months Of Unemployment And You Re Behind On Your Mortgage Or Tax Pa Tax Payment Unexpected Expenses Mortgage

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Deducting Property Taxes H R Block

Dakota County Mn Property Tax Calculator Smartasset

States With The Highest And Lowest Property Taxes Property Tax High Low States

How Is Tax Liability Calculated Common Tax Questions Answered

What S My Property S Tax Identification Number

Property Taxes How Much Are They In Different States Across The Us

Redi Ceo Says High Property Taxes Likely Deterring Growth In Pocatello Local Idahostatejournal Com Property Tax Pocatello Economic Development

States With The Lowest Property Taxes 2022 Bungalow

What S My Property S Tax Identification Number

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

Getting Behind On Your Taxes Is Becoming More And More Common For The American Taxpayer Anything From Your Payroll Deductions Medi Tax Debt Debt Filing Taxes

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)